EmployerSelf-employedGovernments

How to start a bike plan at work?

Situation: you recently read an interesting article about the company bicycle that inspired you...

A company bike as an alternative to a car or as a nice extra, that will score you bonus points with your staff. What are the main advantages of a company bike? And how practical is it?

When offering a (electric) company bike, you can choose between leasing or purchasing.

If you provide a bike - whether leased or purchased - to an employee, and the employee regularly uses that bicycle for commuting, that bike is 100% tax deductible. This applies to both regular bikes and electric bikes, including non-autonomous speed pedelecs.

If your employee also receives a bike allowance, then that too is fully deductible. The maximum exempt amount is fixed at €0.27 per kilometer.

Not only the bike and bike allowance, but also maintenance costs are 100% deductible. The same goes for accessories, such as helmets, padlocks, fluorescent jackets, child seats, etc.

Not a bad deal for you ànd your employees who don't have to pay a benefit in kind like with a company car. The bike will be completely exempt from income tax.

If your employee regularly uses the bike for commuting, and you let that employee pay for the bike through the principle of salary exchange, then part of the salary does not count as a salary benefit on which employer social security contributions must be paid.

By giving that savings back to the employee through an investment in the bike in the form of a discount for the employee, you as an employer can establish a completely cost-neutral bike plan (possibly with bike reimbursement).

If the bike is used by the employee exclusively for private travel, then it will be considered a wage benefit and NSSO contributions and taxes will apply.

More bikes result in fewer cars on the road and consequently more space in your parking lot. This cost is often underestimated: one parking space, quickly adds up to 18,000 euros on an annual basis. This justifies a small investment in a bike shed, right?

Offering a company bike to your employees makes your image as an employer more modern and green, which not only contributes to an increased retention rate, but also attracts new employees. It gives your company a sustainable character and ensures that you remain relevant to future talent.

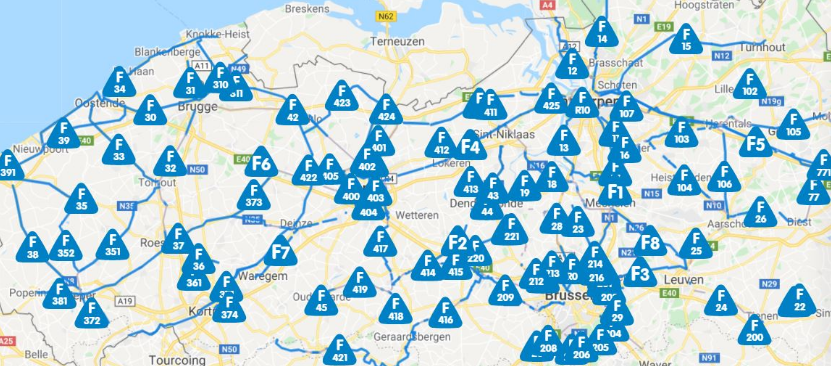

The Flemish and Brussels governments are total fans of cycling. The best example of this is the growing number of bicycle highways. A bicycle highway provides a quality bicycle connection between cities, residential areas and important employment sites. You can consult the active and planned bicycle highways online.

Starting the day with a bike ride to work provides energy and a breath of fresh air. In addition, it leads to less stress and has a positive impact on employees' fitness and health, an advantage that traffic-jam driving colleagues will only envy.

Added bonus: employees who travel 3 kilometers by bike 3 times a week are on average a day less absent due to illness each year than their car-driving colleagues.

Another convincing reason: 20 kilometers a week on the bike will make you sweat out 11 packs of French fries on an annual basis. No more guilt about those Friday fries. Yes!

content marketeer

Situation: you recently read an interesting article about the company bicycle that inspired you...

As a customer at Joule, you choose the maintenance formula that works for you: maintenance and...

Want to be informed about the ins and outs of the cycling world? Then sign up for our newsletter here!